Between being successful at buying low and selling high — the essential formula for merchants of any kind — and having the ability to corner the market by buying up a large amount of the area’s onion supply, Kosuga, and his partner made it big and became rich. Their unprecedented success made them stars in the commodities market and beyond.

The relatively small storage house that Siegel owned at the outset of his business venture with Kosuga eventually gave way to huge warehouses. At one point in 1955 and into 1956, the warehouses stored over thirty million pounds of onions, which would take almost one thousand carloads to transport.

Vincent Kosuga Got Rich by Manipulating the Onion Market

In the 1950s America, farmer and commodity trader Vincent Kosuga and his partner Sam Siegel hatched a plan to control the onion market in and around Chicago. Not only did the scheme work for a time, earning them millions of dollars, but it also caused the United States to pass a law to prevent those practices from being implemented.

Vincent Kosuga was born in 1915 in Pine Island. It's a small hamlet in New York state that is part of what is called the Black Dirt Region, which is best known for so-called “black dirt onions,” so his knowledge and familiarity with the vegetable went back to his earliest days.

Kosuga Started Out as a Farmer

Kosuga came from a Russian-Polish Jewish family before converting to Catholicism. His devoutness and generosity made him important in his church and community. In his early years, Kosuga labored only as a farmer, growing onions, celery, and other crops. Kosuga’s customers included small-time businesses and big companies like Campbell’s Soup, but his involvement in trading wheat futures in the 1930s nearly bankrupted him.

Commodities trading is when investors buy and sell different commodities like oil, gold, and vegetables and speculate on their prices. This kind of trading may be done to create liquidity, secure raw materials, and as a way to invest by speculating on the future prices of such commodities.

Kosuga Began Trading Onion Futures in Chicago

Even though Kosuga’s first experiences in trading futures turned out badly and forced him to focus solely on his farming, by the time he was in his forties, his venture into that area of investment resulted in much larger success. In the mid-1950s, he became involved in the Chicago Mercantile Exchange, where onion futures were hotly traded products.

It was in Chicago that Kosuga began working with Sam Seigel. Seigel owned a facility that worked well as an onion storage, so both partners began buying onions not just locally but from all over the country and soon after began buying onion futures. It was a strategy that eventually led them to corner and manipulate the onion market.

Kosuga and Seigel Prompted the “Onion Futures Act”

It wasn’t long before Kosuga began using deceitful strategies to boost his success as a futures trader. His actions led him to become a wealthy and famous man, but they also directly resulted in the United States Congress passing the “Onion Futures Act” in 1958, which banned the trading of futures contracts on onions.

It is not surprising that the U.S. government eventually took notice of Kosuga and Seigel’s activities: by the end of 1955, the pair had bought millions upon millions of pounds of onions and were so involved in futures trading that they allegedly controlled over 95% of all available onions in Chicago. The reported windfall for Kosuga and Siegel was huge: over 8 million dollars, which today would amount to over 80 million dollars.

Using Bribery and Deceit to Succeed

Kosuga’s strategies to manipulate the onion market and increase profits came in different shapes and sizes. He once convinced a local weather service, most likely through bribery, to issue a frost warning on the region when there was no indication a cold front was coming. This warning, if real, would pose a great risk to onion crops, which inflated the price of onion futures contracts, thus making the owners of such contracts, like Kosuga, a pretty penny.

Clearly, thinking outside the box wasn’t the only way Kosuga rose to success: creating and maintaining relationships with the right people was also essential. He was known to shower associates with gifts and bonuses, even gifting his brokers expensive cars during a particularly successful business year.

Hoarding Large Amounts of Onions

Though Kosuga and Siegel’s business practices were sometimes quite creative, their main strategy was relatively straightforward: come to own a huge share of the onion market and then store the product in order to create a shortage in the market. Once this was done, they would begin selling their stock at a higher price, profiting from the shortage they had a central role in creating.

Helping their strategy was the fact that back then, just as today, onions were an essential food product all throughout the United States. Whether they were used raw in salads or cooked along with meats or to make sauces or condiments, these versatile vegetables were used constantly and in a variety of ways by citizens of all classes.

They Stored More Than Thirty Million Pounds of Onions

Between being successful at buying low and selling high — the essential formula for merchants of any kind — and having the ability to corner the market by buying up a large amount of the area’s onion supply, Kosuga, and his partner made it big and became rich. Their unprecedented success made them stars in the commodities market and beyond.

The relatively small storage house that Siegel owned at the outset of his business venture with Kosuga eventually gave way to huge warehouses. At one point in 1955 and into 1956, the warehouses stored over thirty million pounds of onions, which would take almost one thousand carloads to transport.

They Forced Onion Growers to Buy Their Onions

By the second half of 1955, millions of pounds of onions had to be shipped into Chicago to cover the purchases, both in onion produce as well as futures, made by Kosuga and Siegel. Owning such an outsized portion of the area’s onion inventory allowed them to essentially blackmail growers into buying their onions.

Kosuga and Siegel told growers that if they wanted to, they would flood the market with the huge number of onions they already had stored, which would cause the prices of the vegetable to go down precipitously. At the time, a bag containing 50 pounds of onions cost an average of $2.75, and the antics of the two merchants and businessmen threatened to affect that price significantly.

They Betrayed Onion Growers to Boost Their Own Profits

Most onion growers gave into the demands of Kosuga and his partner and began buying onions at the price they set to avoid the price decrease in the product that Kosuga had threatened. But as this was going on, the duo began to purchase short positions on a large amount of onion futures, which meant they were expecting the prices of that commodity to decrease.

Because many of their onions had begun to spoil — or perhaps because they intentionally wanted to create an image of onions flooding the market — Kosuga and Siegel began to ship their inventory out of Chicago so that the produce could be serviced and then reshipped back to the city.

The Onion King’s Manipulations Caused Prices to Fall

As the shipments of onions that had originated in Chicago began to be shipped back into that very same city, it created the sentiment that there was an excess of onions in the market. This effectively lowered the price of onions, which played right into the hands of Kosuga and Siegel, who had lavishly purchased positions in the futures market that predicted a fall in the price of onions.

This trend continued into 1956, by which point onion prices had dropped shockingly low: a 25-pound bag that used to cost around $1.37 a year prior was now priced at approximately 5 cents. So large was the amount of onions flooding the Chicago market that it caused onion shortages to plague other areas of the country.

Farmers and Growers Were Badly Affected

Kosuga and Siegel made millions from this scheme while leaving many farmers in a precarious position of financial loss: many were left with large amounts of high-priced onions that were impossible to sell, and in several cases, these growers had to pay out of pocket to get rid of all that inventory. Needless to say, this led a good number of farmers to be forced to declare bankruptcy.

What had begun as a deal between Kosuga and the growers would supposedly help everyone involved. The farmers would buy the inventory from the merchants, who would then hold on to the inventory until demand surged. This ended up negatively affecting the growers when the merchants decided to make their profits by lowering onion prices instead of increasing them.

The Federal Government Was on Alert

A maneuver this big from Kosuga and Siegel affected many people negatively and did not go unnoticed. By the late spring of 1956, the Commodity Exchange Authority (the regulatory arm of the government which oversaw commodities trading) caught wind of the plan put into action by Kosuga and his partner and declared the duo was involved in a conspiracy designed to depress the prices to cover their short position.

But this was not the only government body to get involved: the Senate and the House Agriculture Subcommittee also began to hold hearings on the situation, all of which led to the eventual ban on trading futures contracts on onions.

Kosuga Didn’t Think He Was Doing Anything Wrong

When Kosuga and Siegel’s activities began to be known by the wider public and the media, Kosuga’s attitude was unrepentant, and he was quoted as saying, “If it’s against the law to make money…then I’m guilty”. When the House and Senate subcommittee meetings took place, and Kosuga was called to testify, his attitude was the same as he defended himself and his practices.

During these hearings, one of the main arguments made on why onions were particularly at the mercy of being manipulated as commodities was that they are highly perishable. As a result, they are more at risk of being affected by price swings.

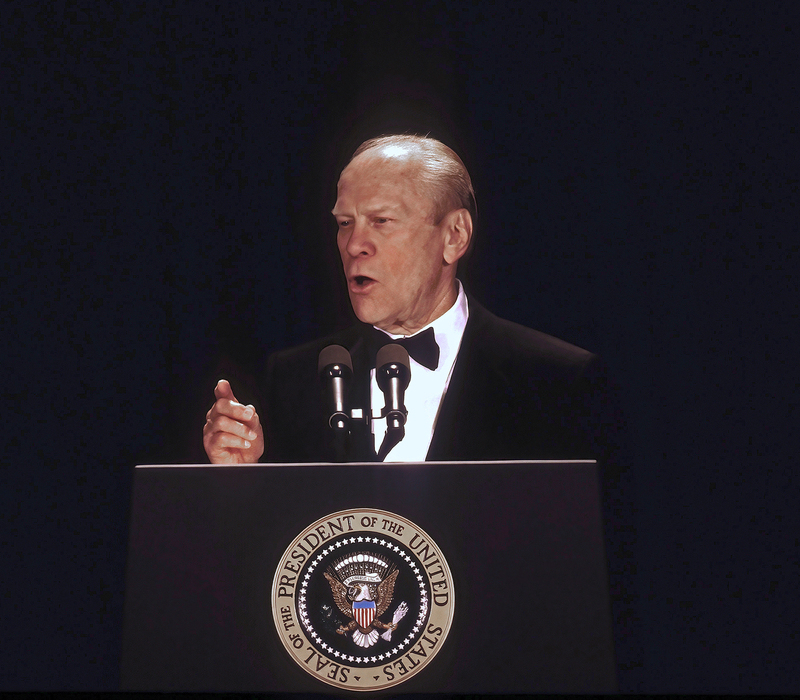

President Ford Sponsored the Onion Act

The congressional hearings involving Kosuga and his partner drew the attention of Gerald Ford, then a congressman from Michigan. If the name sounds familiar it's because two decades later, Ford would rise to fame as Richard Nixon’s vice president in 1973, ultimately becoming president after Nixon resigned the following year.

Ford would keep the position until losing reelection to Jimmy Carter in 1977. Ford sponsored the bill that became known as the Onion Futures Act, which would forever enshrine Kosuga into the history books and make onions the only trading commodity to be banned in the United States to this day.

President Eisenhower Turned the Onion Act Into a Law

On August 28th, 1958, President Dwight D. Eisenhower signed the Onions Futures Act, and it officially became law. What had begun as an idea to play the commodities market in Chicago by Vincent Kosuga had spiraled in such a way that it prompted Congress to officially make a law to prevent what he and Sam Siegel had done and gotten away with. After all, their market manipulations were not illegal when they committed them.

In 1961, after the Chicago Mercantile Exchange failed to successfully challenge the law in federal court, it drew its attention to coming up with a new commodity to trade in the futures market: pork-belly futures. That’s right — Vincent Kosuga inadvertently set the course for the trading of frozen pork bellies.

Eisenhower Made Several Other Laws

Dwight D. Eisenhower, president of the United States from 1953 to 1961, had a busy presidency, and the Onion Futures Act was one of several key bills he signed into law that were part of his agenda. Two years prior to that bill, he promoted and signed a bill to create the Interstate Highway System, which laid the foundation for the most important highways and roads in the United States.

He also signed the National Defense Education Act in 1958, which infused large amounts of funding into the educational system with a focus on strengthening national defense. A year earlier, Eisenhower also signed the Civil Rights Act of 1957, which intended to support and enforce the 1954 Supreme Court ruling that officially banned segregation in schools.

Kosuga and His Partner Were Banned From Trading

The bill titled “The Onion Futures Act,” as put forward by Gerald Ford, dictated that all onion futures traded in the future would have to be sorted out in cash as opposed to actual physical onions. It also proposed that the government should have the right to set limits on the quantity of onion futures that could be traded.

Unsurprisingly, the Chicago Mercantile Exchange opposed both measures and opposed the bill in general. In the end, trading onions as a commodity was banned. For Kosuga and Siegel, the consequences they faced seem, in retrospect, to have been minor: their registrations as brokers were revoked, and they were banned from trading for ten months.

Most Traders Didn’t Like the New Law

Despite the damage that Kosuga and Siegel’s actions caused, the Onions Futures Act was not generally popular among traders. E.B. Harris, a prominent voice because of his position as president of the Chicago Mercantile Exchange, went hard against the bill and was quoted as saying “We submit that burning down the barn to find a suspected rat is a pretty drastic remedy.”

The fight against the bill continued after its passing in 1958, as the Chicago Mercantile Exchange filed a lawsuit in federal court to have it struck down on the basis that it restricted trade in an unfair and unnecessary manner. That lawsuit proved to be unsuccessful, at which point the CME decided to drop the fight instead of taking it to the Supreme Court.

Chicago’s Pork Belly Market Closed Down

After Kosuga and Siegel’s onion scheme caused onions to be banned from being traded at the Chicago Mercantile Exchange, one of the commodities that took their place was pork bellies. They came onto the scene in 1961 and enjoyed a lot of success through that decade and the 1970s.

By the time pork bellies futures trading was shut down in 2011 due to a lack of demand and activity, they had been the oldest livestock futures to trade in the country. Harvey Paffenroth, who happened to be none other than Kosuga’s nephew and was a member of the Chicago Mercantile Exchange, said that pork bellies were the glamour market.

Kosuga Opened a Restaurant in His Hometown

In the early 1960s, Kosuga returned to his corner of New York state, Pine Island in Orange County, and opened a restaurant he and his wife named “Ye Jolly Onion Inn.” The restaurant boasted a large and diverse menu and a full bar and also included live music and other special events. Over the decades, the restaurant enjoyed great success even as it passed through two different owners after Kosuga sold it in 1970.

The restaurant closed down in 2008 but was reopened a decade later under new management. To this day, it remains a popular destination for locals and visitors alike, whether it is visited for a casual meal or to celebrate occasions like weddings and graduations.

“The Jolly Onion’s” Star Dish Is Sweet Onion Soup

Though the Kosugas aren’t around anymore, “The Jolly Onion” is still going strong, keeping up the tradition of having a menu centered on European dishes as well as American classics. Favorites include the Amsterdam Bitterballen Croquettes, Bavarian Pretzels, Swedish Meatballs, Jager Schnitzels, Potato Pancakes, and Bacon Wrapped Scallops.

But the most popular menu item is the Sweet Onion Soup. Per the restaurant’s staff, they make around 200 gallons of this soup a week. Apart from the talent of the kitchen staff, the dish owes its reputation to the fact that onions from the region are known to be especially tasty and intense thanks to the rich black soil that characterizes the area.

Kosuga Was Voted Citizen of the Year by His Neighbors

Vincent Kosuga was nothing if not an interesting and, at times, contradictory figure. He reportedly always carried a .38 pistol with him for protection, met with at least one pope in his lifetime, and once survived a plane crash in upstate New York that left him in a full-body cast.

Despite his, at times, unethical business practices, he was known as a charitable member of his community and was voted Citizen of the Year in Pine Island in 1987. The honor was given to him by the Pine Island Chamber of Commerce, which declared that his success was the perfect example of the American Dream coming true.

Kosuga and His Wife Were Popular

The Onion King and his wife were known as generous people in and around the area of Pine Island. They founded the Vincent and Pauline Kosuga Foundation in 1997, through which they made various donations, and which continues to make an impact: as recently as 2020, the foundation made a $100,000 donation to the Warwick Valley Humane Society and nearly $60,000 to the Orange County Mental Health Association.

Pauline Kosuga herself was very involved in her community and church and, among other things, established the Kosuga Scholarship to the Agricultural College at Cornell University. She also received a Citizen of the Year Award from the Pine Island Chamber of Commerce, as well as awards from Middletown & Arden Hill Hospital and the Horton Memorial Medical Center.

Pauline Was Nicknamed “Polly”

Pauline "Polly" Kosuga, first known as Pauline Paffenroth, was born on July 18th, 1915, in Pine Island, New York. She met Vincent Kosuga at a young age, and they were married for sixty-four years until Vincent’s passing in 2001. She died in 2009 at the age of ninety-four. "He was charming when he wanted to be," Pauline said of her husband after his death and described him as her longtime partner and her best friend.

Though Vincent made his name and fortune in Chicago, she always asserted that his heart was in Pine Island. She was a farmer, like her husband, and co-owner of “Ye Jolly Onion Inn,” where the pair operated throughout the 1960s.

Onions have Been Farmed for Thousands of Years

When Vincent Kosuga took up onion farming, he was following a practice that humans have been practicing for millennia. Onions have been farmed, eaten, and utilized for at least six thousand years. They have been found in archaeological sites that date back to ancient China, India, Iran, and other places around the world.

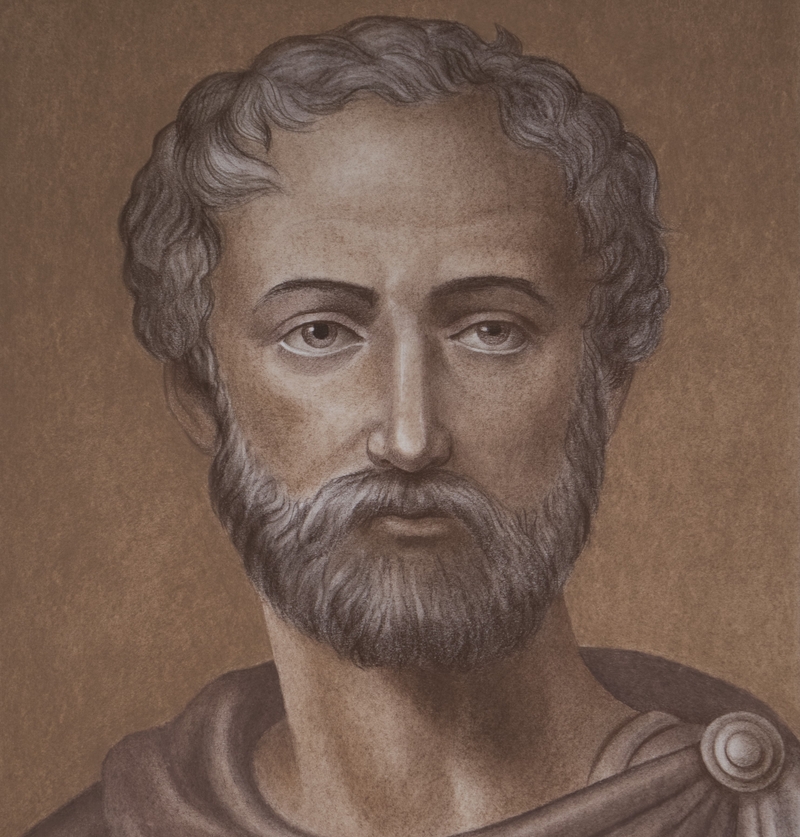

The vegetable was not only found in kitchens and mess halls: onion traces were discovered in the tomb of Pharaoh Ramesses IV of Egypt, who ruled around 1150 BC. Around two thousand years ago, a famous Roman military leader named Pliny the Elder wrote not only about the onion as a tasty food but also about its health benefits; he claimed it helped to deal with dysentery and mouth sores and even worked as a sleep aid.

Onions Were a Part of Kosuga’s Hometown Long Before He Came Along

Onions have been an essential part of Pine Island’s history and identity for at least the past two centuries. The area that Kosuga called home has soil that is high in sulfur, which is key to giving the onions grown there a particularly strong and desirable taste — especially when it comes to cooking them.

It’s no surprise, then, that the most famous dish in the restaurant that Kosuga originally founded, “The Jolly Onion,” is its sweet onion soup. The dark and organically rich soil is what gave Pine Island and its surroundings the name of Black Dirt Region. It could be said that Vincent Kosuga’s life would not have become so entangled with onions had he not been born there.

The Soil Around Kosuga’s Hometown Gave the Area Its Colorful Name

The soil of Pine Island and the rest of the Black Dirt Region makes the flavor of the onions grown there “brighter, sharper, cleaner,” according to local Farmer Cheryl Rogowski. In her estimation, this flavorful distinction is particularly present when it comes to making smoked onion jam, which she says will not taste the same if it is made with onions from a different region.

Kosuga, Rogowski, and many other local farmers are descendants of Polish and Russian immigrants. Their ancestors first settled in the region at a time when most people in that area were of Irish descent — many of whom had made it to the United States to escape the well-known potato famine that gripped Ireland in the middle of the 19th century.

Kosuga Was Part of a Large Population With Russian and Polish Heritage

Kosuga always felt most at home in his hometown of Pine Island: it is where his family and friends lived, where he first learned how to farm and came to love onions, and it was a place that was conscious of and celebrated the Russian and Polish ancestry of many of its residents, Kosuga included. During his youth, there used to be local festivals and celebrations of each year’s harvest that were influenced by the Polish tradition called “Dożynki.”

Elaborate traditional costumes were worn, and people danced to polka music, all while big decorations made to resemble onions surrounded the events. For many, the highlight of these celebrations was the crowning of the Onion Princesses and Onion Queens, who would wear costumes and dance.

Kosuga Was a Businessman During a Booming American Economy

Kosuga was busy becoming an onion magnate in the mid-1950s, a time when America was experiencing an economic boom. Having come out victorious from the Second World War — and without having endured the physical destruction Europe had to recover from — the country began a period of intense industrialization and consumerism that, in many ways defined the identity and reputation of the United States.

Many commercial brands and iconic companies that still thrive today were founded around the time Kosuga and his business partner Siegel were scheming to become rich. Some examples include the popular dinner chain “Denny’s” and fast-food icon “McDonald’s” — founded in 1953 and 1955; the tax company “H&R Block,” which began in 1955; and the retail company “Williams Sonoma,” which opened its first store in 1956.

Kosuga Was Included in an Influential Book

The 2010 book by Emily Lambert, “The Futures: The Rise of the Speculator and the Origins of the World's Biggest Markets,” takes the reader into the history of commodity exchanges and the men who made their mark on those markets. The author focuses on the storied Chicago Mercantile Exchange, first formed in 1898, in part to help protect farmers from the risks of their volatile line of work, but which was also used by unscrupulous speculators like Kosuga to get rich quickly.

Chapter 4 is devoted to the machinations of Kosuga and Sam Siegel, which heavily influenced how laws surrounding commodity trading would be shaped. The influential market, known short as “The Merc,” served as the model for similar exchanges that popped up internationally as the 20th century unfolded.

India’s Very Own Kosuga

Mangesh Varpe, a farmer from the town of Kalamb in the Indian state of Maharashtra, aspires to one day be like Vincent Kosuga. An onion farmer himself, he earns a living by traveling to Mumbai and selling his produce there. He has said that selling onions in markets in the big city has awakened in him a sense of entrepreneurship and a desire to barter and negotiate prices.

“I want my onions to go overseas, and this market will help me achieve my dream of becoming Vince Kosuga,” said Varpe in 2017, “don’t underestimate this powerful vegetable…when it sells, it makes a poor farmer like me very happy”. As far as reaching the commercial heights Kosuga did, Varpe still has a long way to go.

Kosuga Helped a Major Trucking Company Get Started

Carroll Fulmer Logistics is a transportation and logistics business with humble beginnings dating back to 1954, when Carroll Fulmer himself began hauling farm produce to markets in the American South. In 1961, he began transporting vegetables to the East Coast, which is when he met Kosuga. According to Carroll, Kosuga got his attention by throwing an onion to the back of his head.

The two became fast friends and business partners, and Carroll ended up moving his family and most of his business to Pine Island, Kosuga’s hometown. With Kosuga’s help, he founded the Ridge Truck Brokers company, which specialized in long-distance produce delivery. Over time, these ventures became the Carroll Fulmer Logistics Corporation, which these days works with some of America’s largest companies.

Kosuga Faced Other Legal Challenges Later in Life

Being a farmer, businessman, and trader for decades, it’s no surprise that Kosuga spent time dealing with lawyers and lawsuits on more than one occasion. In 1973, Kosuga had already been living in and around Pine Island, New York, for years after having lived in Chicago during the 1950s. In that year, an attorney from the neighboring city of Middletown filed a suit against Kosuga and other individuals on charges of libel.

The attorney, Anthony Kelvasa, claimed that Kosuga and the others had sent a dishonest letter to an Appellate-Division Judge in which they asked that Kelvasa be prosecuted on charges of forgery, perjury, and grand larceny. The complex conflict revolved around disagreements involving the ownership of a 250-acre farm near Pine Island called the Merrit Onion Farm.

Kosuga and Other Farmers Suffered Heavy Crop Losses

In the same year that Kosuga and Siegel were deep into their plans to corner the onion market in Chicago, heavy flooding in and around Kosuga’s hometown caused farmers to lose huge amounts of their crops. Around 70% of the area’s onion harvest was said to be ruined, causing farmers to claim losses of nearly two and half million dollars — a huge sum by 1955 standards and likely a low estimate compared to the total damage done.

The report of the incident by the State Department of Agriculture said that crates that were stacked in the fields after harvesting were damaged as the water was two to five crates high. The flooding occurred in August, just ten days after local farmers had kicked off festivities to celebrate a successful harvest season.

Kosuga’s Farm Was Pictured in the News

When the regional newspaper “The Newburgh News” reported on the summer floods that affected farmers in and around Orange County, New York, it was a picture of Kosuga’s own farm that made the front page on August 24th, 1955. “The onion and celery crops of Vincent Kosuga at Pine Island were inundated when the Wallkill River and Pochuck Creek overflowed their banks,” stated the news article, which also mentioned that other crops affected included carrots, beets, cabbages, and potatoes.

Several government bodies such as the Vegetable Commodity Committee, as well as the U.S Farmer’s Home Administration, worked to declare an agricultural disaster. That kind of declaration gave affected farmers the opportunity to apply for federal loans that helped them gain financial footing after their heavy crop losses.

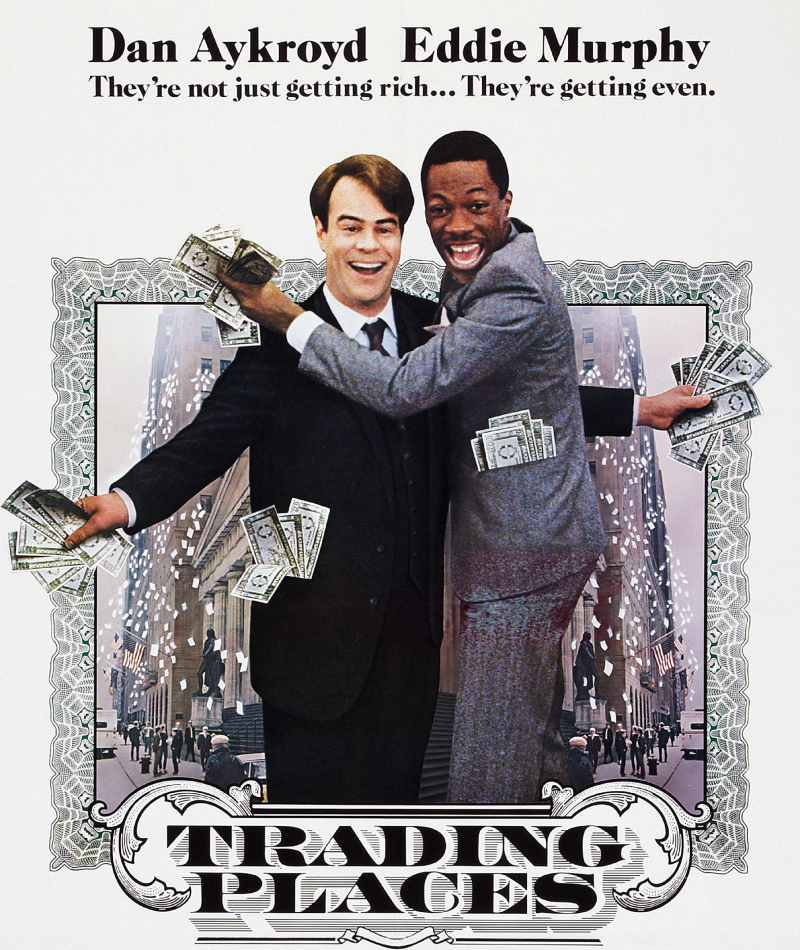

A Classic Eddie Murphy Movie Was Inspired by Kosuga’s Story

“Trading Places” is a classic comedy from 1983 by John Landis, director of other iconic 80s films like “The Blues Brothers,” “Animal House,” and “Coming to America.” It stars Eddie Murphy and Dan Aykroyd, then at the top of their careers and comedic powers, in a story that was inspired by Kosuga and his partner Siegel’s onion market scheme.

In the film, a snobby executive and street-smart hustler team up to bankrupt a pair of rich and corrupt brothers by cornering the frozen orange juice market. Frozen orange juice, used as a substitute for Kosuga’s onions, was actually one of the commodities introduced by the Chicago Mercantile Exchange once onions were banned from the market because of Kosuga’s antics.

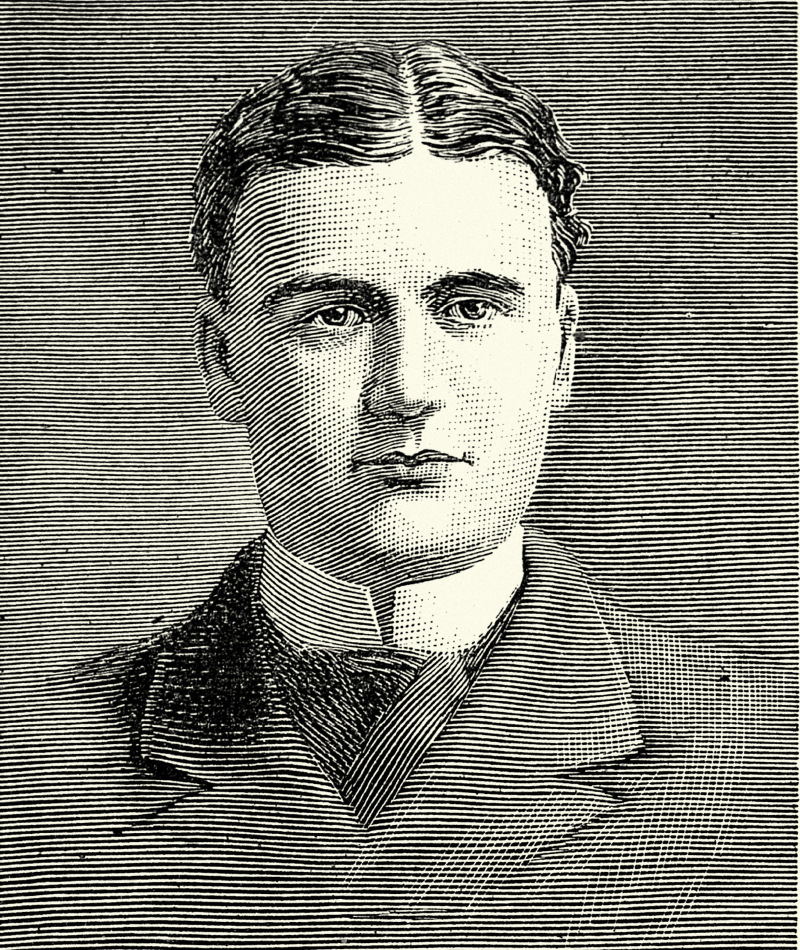

Kosuga Wasn’t the First to Manipulate the CME

While Kosuga and Siegel’s plan to corner the onion market may have been the most ambitious manipulation scheme seen in the Chicago Mercantile Exchange, it was by no means the first. In 1897, a man named Joseph Leiter attempted to corner the wheat market and nearly pulled it off if not for the efforts of a man called Philip Armour.

The well-known businessman hired ships to break the ice along parts of the Great Lakes so that ships carrying wheat could be transported from Minnesota to harbors in Chicago. It effectively dashed Leiter’s plans to take advantage of wheat shortages in the same way that Kosuga would count on the onion shortage nearly fifty years later.

Cornering Markets Happened in the Early 20th Century

When Kosuga cornered the onion market in the Chicago Exchange, he was joining an already rich tradition of people attempting to manipulate markets and businesses. The first of these cases in America at the turn of the 20th century was the cornering of the Northern Pacific Railway in 1901. This case caused such waves that it was partly responsible for the very first crisis of the New York Stock Exchange.

As opposed to cases like Kosuga’s, where the culprits were more or less average businessmen, this scheme involved some of the biggest business titans of their time: J.P. Morgan and William Rockefeller. Along with their respective partners, they were in a fight to control the Northern Pacific Railway — the transcontinental railroad that ran from Minnesota to the Pacific Northwest.

A Pair of Brothers Tried to Imitate Kosuga in the 1970s

The Hunt brothers, Nelson and William, tried to corner the silver market — not of a city or state but of the whole world. Both worked on an elaborate scheme to control a huge amount of the globe’s available silver and did, in fact, at some point hold the rights to over half of the world’s deliverable silver.

Their actions contributed to a large change in silver prices: the beginning of 1980 saw an ounce being worth nearly 50 dollars, up from around 11 dollars from September of the prior year. When prices finally did go down in March, they went down hard, falling well below 11 dollars an ounce in what came to be known as “Silver Thursday.” All in all, the Hunt brothers lost over a billion dollars in the ordeal.

A Kosuga-Style Scheme in Japan

Yasuo Hamanaka, a trader who used to work for Sumitomo Corporation, gained notoriety after attempting to corner the world copper market in a scheme that spread out over nearly ten years. His plans didn’t work out, and by 1996 he was left with very large copper positions that were worth much less than he had planned.

The losses incurred by Hamanaka added up to more than 2.5 billion dollars, which as of now ranks #14 in the list of top trading losses ever. Hamanaka spent a lot of time and energy to hide the losses that eventually came to light, which included keeping a secret records book, forging data and signatures, and lying to his bosses. In 1997, he was sentenced to eight years in prison in Tokyo.

A Group of Reddit Users Briefly Influenced the Market in 2021

In an example of stock market manipulation in the era of social media, two companies' stock prices were sent on a whirlwind ride by “Wall Street Bets,” a subreddit belonging to the social media site Reddit. The subreddit, which analyzes the stock market with a satirical and comical approach, got together to buy the stocks of movie theater company AMC and video game seller GameStop.

These two companies were on a downward spiral. Their stock buying gained momentum, and for a while, the prices for both companies went through the roof before crashing back to reality. Though this event did not come close to what Kosuga did back in the 1950s, it is an interesting example of how manipulating markets has evolved with the times.

Onion Farming Is Still a Tough Business

Because growing onions depends a lot on the whims of the weather and other factors that are hard to control, being in the onion business was never a particularly easy task before, during, or after Kosuga’s time. After Kosuga and Siegel were taken out of the market for a time, the price of onions was still volatile, often rising and falling unexpectedly.

Ironically, banning onion futures also limited the financial options of farmers: before, futures were another tool in the toolbox by which farmers could sell their produce ahead of time — instead of having to pay the costs of storing them, for instance. After Kosuga and the legislation that his actions inspired, this was no longer possible.

The Onion Futures Act Was Amended in 2010

Strangely enough, the Onions Futures Act was amended 52 years after its passing to include, of all things, movie box office futures. The amendment came after lobbying from the Motion Picture Association of America, which did not approve of the increasingly common practice of folks speculating about the box office success or failure of movies.

Such activities lent themselves to be subject to insider trading, which is why the amendment included a provision that stated that box office receipts could only be valid for two days after being emitted. Echoing the language used back when the Onion Futures Act was passed, the Motion Picture Association argued that allowing box office futures to flourish would allow “unbridled gambling” and would negatively affect the integrity of the film industry.

Could Kosuga Have Pulled This Off Today?

Even though market manipulation can still occur today in more sophisticated ways, the short answer is no: Kosuga could not have cornered the onion market today in the way he and Sam Siegel did in the 1950s. The reason is that there is so much more information out there, making it much easier to expose schemers like Kosuga.

If someone tried to buy such large amounts of a commodity like soybeans or cocoa — not to mention transporting and storing them — it would be harder to hide in 2023 than in 1953. Similarly, making such big moves in the futures market, with all the digital technology now involved in it, would quickly raise eyebrows as well.

Kosuga Died in His Hometown

Kosuga passed away at the ripe age of 86 in January 2001 in Goshen, New York, close to his beloved town of Pine Island. He died just two days after his birthday, which was the same day as his wedding anniversary to Pauline, his wife of over six decades, who died eight years later. Upon his death, Pauline stated that her husband “was the biggest onion grower in the east.

Everyone called him The Onion King" and added, "He always was the leader. Vincent was a very bright boy”. The pair, who were both born in the same year, had known each other since their teenage years, and Pauline remembered him as "a friend” and “a loyal husband.”